- Legal Status in Nigeria

- CBN Foreign Exchange Regulations

- Following SEC Nigeria Trading Rules

- Trading Platforms for Nigerian Traders

- MT4 & MT5 Download

- Account Opening Requirements

- KYC Documentation Process

- Minimum Deposit ₦3,000-5,000

- Payment Methods in Nigeria

- Bank Transfer & Domiciliary Accounts

- Instant NGN Deposits

- Leverage Options up to 1:Unlimited

- Trading Conditions & Spreads

- Customer Support in Hausa, Yoruba, Igbo & English

- Frequently Asked Questions

Legal Status in Nigeria

Before you begin trading with Exness, it’s important to understand its legal status in Nigeria, including how it complies with local regulations and financial laws.

CBN Foreign Exchange Regulations

The Central Bank of Nigeria (CBN) is responsible for regulating foreign exchange trading in Nigeria. The CBN ensures that all forex transactions comply with the Nigerian Foreign Exchange (FX) Regulations. Nigerian traders can use Exness’s services without violating these laws since the platform is regulated by various financial authorities worldwide. However, traders must ensure that they are adhering to the guidelines set by the CBN.

For instance, the CBN allows individuals to trade foreign currencies through licensed brokers based outside Nigeria. Although Exness operates internationally, it adheres to global standards that ensure compliance with Nigerian regulations, allowing Nigerian traders to use its services responsibly. Traders must avoid engaging in unauthorized currency conversion or forex trading without the proper approval.

Following SEC Nigeria Trading Rules

The Securities and Exchange Commission (SEC Nigeria) oversees the Nigerian securities market. While SEC Nigeria is mainly concerned with stock and commodity trading, Exness specializes in forex and CFDs (contracts for difference), which are not directly regulated by SEC Nigeria. Exness, however, maintains high standards of financial compliance and ensures a fair and transparent trading environment, which aligns with SEC Nigeria’s goal of protecting investors and maintaining market integrity.

Exness ensures the security of its clients’ funds and provides transparent trading conditions. While SEC Nigeria doesn’t directly regulate forex markets, Exness follows regulations from other global financial authorities, offering similar protections as those found in regions such as Europe and Seychelles.

Trading Platforms for Nigerian Traders

Exness offers Nigerian traders access to a wide array of financial instruments with high liquidity across several trading platforms. These include MT4, MT5, and the Exness mobile app.

MT4 & MT5 Download

Exness gives Nigerian traders access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms globally. Both platforms are available for free and are user-friendly, featuring many tools designed to make trading easier.

MT4 is favored by forex traders for its simplicity, advanced charting features, and ability to trade via algorithms. MT5, on the other hand, offers more advanced features, such as more timeframes, order types, and a broader range of financial instruments, including stocks and commodities.

Nigerian traders can visit Exness’s official website to download these platforms on their desktop or mobile devices, whether they use Windows, Mac, or smartphones.

Web Terminal

The Exness Web Terminal enables traders to access their accounts from any browser, without needing to download additional software. It offers the same functionality as the MT4 and MT5 platforms, making it an ideal choice for traders who prefer a simple, browser-based interface.

Exness Trade App

Exness offers the Exness Trade app, compatible with both Android and iPhone devices. This mobile app allows traders to monitor their accounts while on the go. Traders can execute trades, view their positions, and track the markets from anywhere, making it easy to stay connected to the markets at all times.

Account Opening Requirements

Opening an account with Exness is straightforward. However, traders in Nigeria must provide specific documents to comply with regulatory requirements. Below are the steps and documents needed to get started.

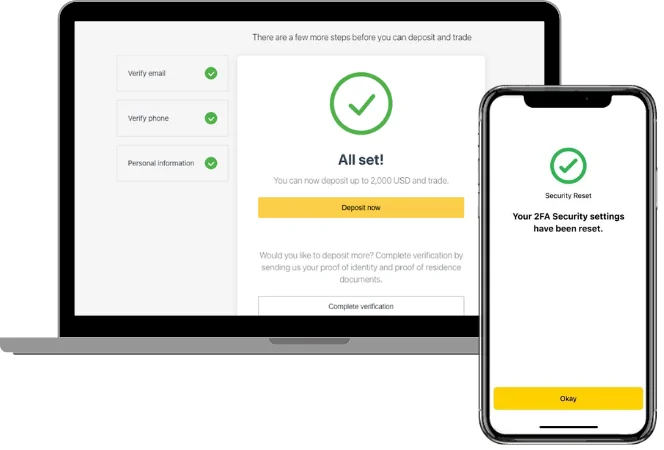

KYC Documentation Process

As part of the Know Your Customer (KYC) process, Exness asks Nigerian traders to verify their identity and address to prevent fraud and money laundering. The required documents include:

- Identity Verification: A government-issued document such as a Passport, National ID, or Voter ID.

- Address Verification: A utility bill, bank statement, or government-issued document showing the trader’s residential address.

These documents are required for both real and demo accounts. Exness ensures that all personal data is securely handled in accordance with global data protection standards.

Minimum Deposit ₦3,000-5,000

To start trading with Exness, Nigerian traders need to make a minimum deposit of ₦3,000-5,000 (approximately $5-10 USD). This low minimum deposit allows traders to begin trading without a large initial investment. The minimum deposit may vary based on the account type and location.

There are various methods to fund your account, including bank transfers, domiciliary accounts, and NGN deposits. Ensure that the payment method you choose is available in Nigeria and supported by Exness.

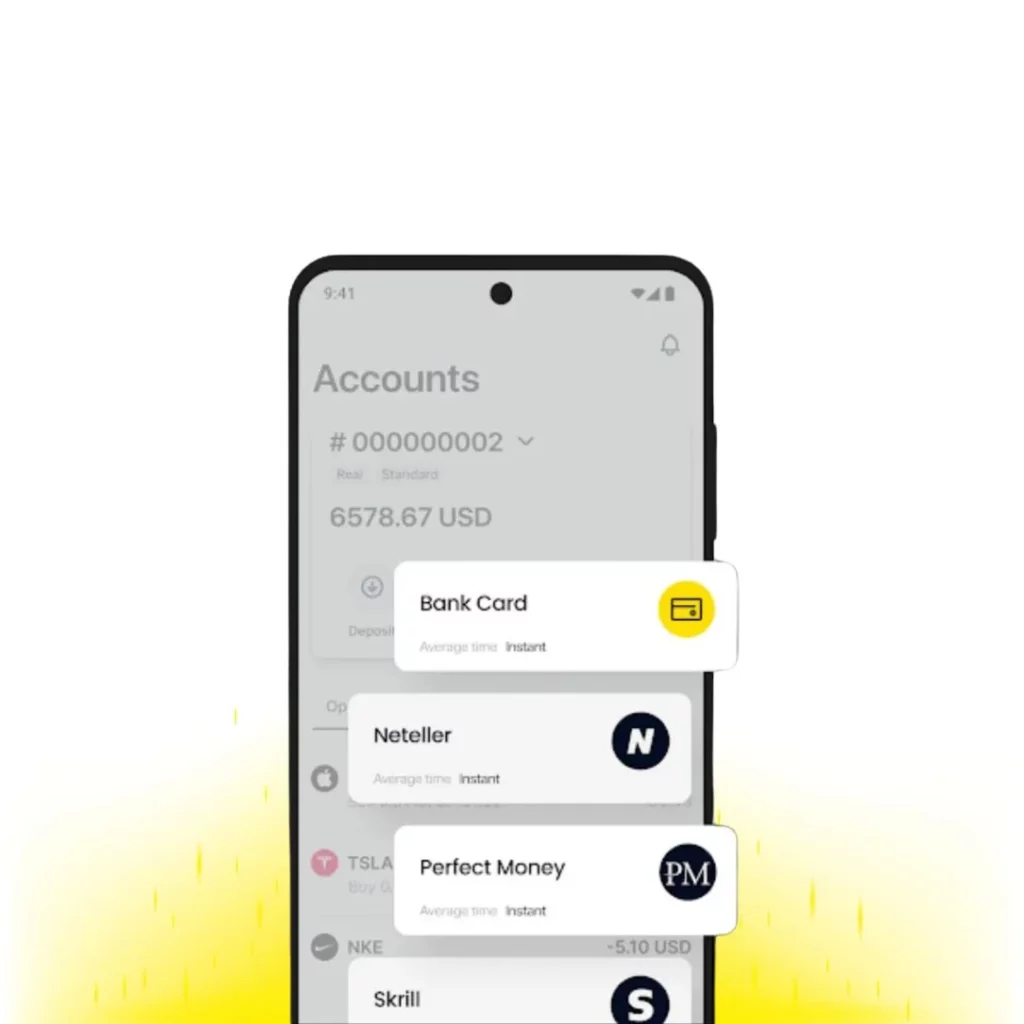

Payment Methods in Nigeria

Exness provides Nigerian traders with several secure and convenient payment options for deposits and withdrawals. This ensures smooth and timely transactions.

Bank Transfer & Domiciliary Accounts

Nigerian traders can make deposits through bank transfers or domiciliary accounts, offering flexibility for different preferences. Bank transfers usually take longer than other methods, but they are a secure way to deposit larger amounts.

Popular Nigerian banks supported by Exness include Access Bank, GTBank, First Bank, Zenith Bank, and UBA. These options ensure that traders can use their local banks to fund their trading accounts.

Instant NGN Deposits

Exness also supports instant deposits in NGN, making it easier for Nigerian traders to fund their accounts quickly. This method is ideal for traders who want to start trading immediately after depositing funds.

Leverage Options up to 1:Unlimited

Exness offers various leverage options, allowing Nigerian traders to control larger amounts of capital with a smaller initial deposit. Traders can leverage up to 1:Unlimited, which means that with a leverage of 1:1000, for example, a trader can control ₦100,000 worth of assets with just ₦100.

Leverage amplifies both potential profits and the risk of losses, so traders must be aware of the risks involved. Exness offers multiple leverage options, enabling traders to choose the level of risk they are comfortable with.

Trading Conditions & Spreads

Exness offers competitive trading conditions and tight spreads, starting at 0.0 pips for major currency pairs like GBP/USD and EUR/USD. Tight spreads are especially beneficial for scalpers and high-frequency traders, as they reduce the cost of executing trades.

Customer Support in Hausa, Yoruba, Igbo & English

Exness provides comprehensive customer support in both English and local Nigerian languages, including Hausa, Yoruba, and Igbo. Traders can contact the support team through various channels such as phone, email, and live chat, ensuring assistance is always available when needed.

Frequently Asked Questions

What types of accounts can Nigerian traders open with Exness?

Exness offers several account types, such as Standard, Pro, and Raw Spread accounts, each with different spreads and commissions to cater to different trading strategies.