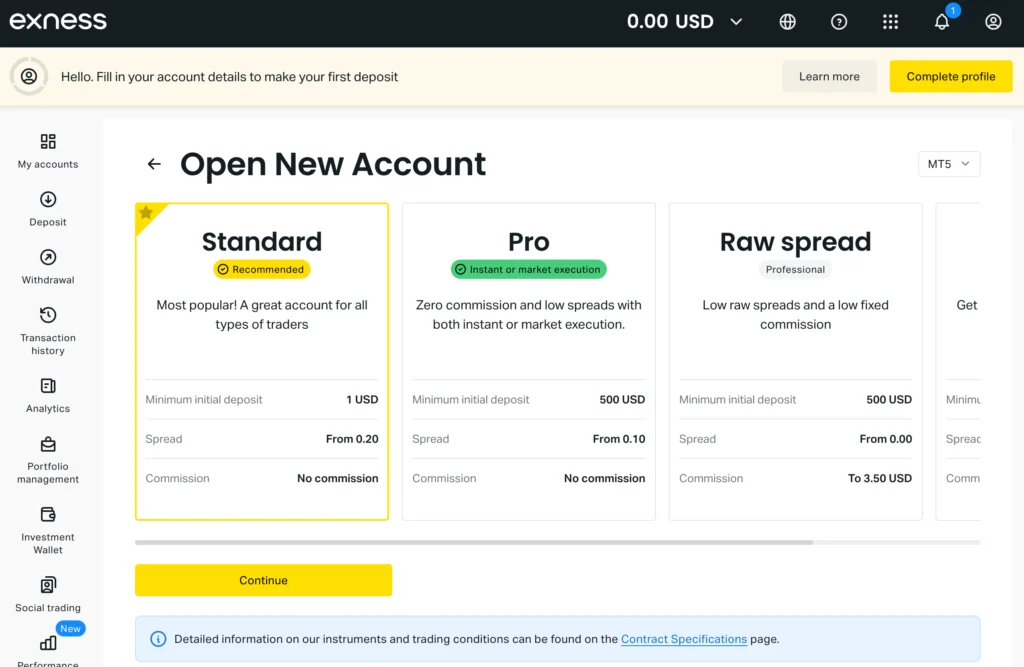

- Standard Account: Ideal for Beginners

- Features & Trading Conditions

- Minimum Deposit Requirements

- ₦3,000 Starting Capital Strategy

- Raw Spread Account: For Active Traders

- Commission Structure & Benefits

- Zero Account: Commission-Free Trading

- Spread Comparison with Other Accounts

- Best Markets for Zero Accounts

- Professional Account: Advanced Trading

- Pro Account Requirements for Nigerians

- Demo Account: Practice Without Risk

- How to Open a Demo Account

- Account Type Comparison Table

- How to Choose the Right Account Type

- Frequently Asked Questions

Standard Account: Ideal for Beginners

The Standard account is perfect for Nigerian traders new to forex or those seeking straightforward trading conditions. It offers a low entry point and user-friendly features, regulated by the CBN and SEC.

Features & Trading Conditions

The Standard account provides spreads starting at 0.3 pips, no commissions, and leverage up to 1:2000. Traders can access forex, metals, and cryptocurrencies on MT4 or MT5 platforms, with support for NGN as a base currency to avoid conversion fees when depositing via bank transfer or domestic accounts with banks like Access Bank, GTBank, First Bank, Zenith Bank, or UBA. The account is beginner-friendly, offering stable execution and no hidden costs, compliant with Nigeria’s Foreign Exchange (FEMA) regulations.

Minimum Deposit Requirements

The minimum deposit is ₦3,000 (~$5). To fund the account:

- Log into the Exness Personal Area and select “Deposit.”

- Choose bank transfer, domestic accounts, or another method, enter ₦3,000 or more, and confirm payment.

- Verify funds in the account balance.

Deposits are instant with supported methods, and Exness charges no fees. Start with the minimum to test the account’s features. Use a demo Standard account to practice trading major pairs like EUR/USD in English, Hausa, Yoruba, or Igbo.

₦3,000 Starting Capital Strategy

A ₦3,000 deposit (~$5) is sufficient to begin. To trade effectively:

- Set leverage to 1:20 to manage risk.

- Trade micro-lots (0.01–0.10) on low-volatility pairs like USD/JPY.

- Use stop-loss orders to protect your capital.

This strategy minimizes losses while you learn. Practice on a demo Cent account to refine your approach. Monitor trades daily to avoid margin calls, ensuring compliance with CBN regulations.

Raw Spread Account: For Active Traders

The Raw Spread account is designed for Nigerian traders who trade frequently and need low costs. It’s optimized for precision and speed, regulated by the CBN and SEC.

Commission Structure & Benefits

Spreads start at 0.0 pips, with a commission of up to $3.50 per lot per side. The account offers fast execution on MT4 and MT5, ideal for scalping or day trading. Leverage up to 1:2000 and KES currency support make it flexible for traders. The low spreads offset commissions for high-volume traders, but calculate costs before committing.

Zero Account: Commission-Free Trading

The Zero account is tailored for Nigerian traders seeking tight spreads without commissions on most trades. It’s ideal for specific market conditions and regulated by the CBN and SEC.

Spread Comparison with Other Accounts

The Zero account offers 0-pip spreads on major instruments 95% of the time, with small commissions on some pairs.

| Account Type | Spreads (Pips) | Commission (Per Lot/Side) | Best For |

|---|---|---|---|

| Standard | From 0.3 | None | Beginners |

| Standard Cent | From 0.3 | None | Micro-trading |

| Raw Spread | From 0.0 | Up to $3.50 | Active traders |

| Zero | 0 (95% of time) | Varies (some pairs free) | Scalpers, major pairs |

| Pro | From 0.1 | None | Advanced traders |

Spreads vary with market volatility. Test the Zero account in a demo to compare costs, especially during high-liquidity hours like London/New York sessions, using platforms in English, Hausa, Yoruba, or Igbo.

Best Markets for Zero Accounts

The Zero account works best for:

- Major forex pairs (e.g., EUR/USD, GBP/USD).

- Gold (XAU/USD) during volatile sessions.

- USD/JPY for low-spread scalping.

These markets offer the tightest spreads, maximizing value. Practice scalping on a demo to perfect timing and monitor spread changes during news events to avoid surprises, ensuring FEMA compliance.

Professional Account: Advanced Trading

The Pro account is for experienced Nigerian traders needing fast execution and low spreads. It’s designed for serious trading, regulated by the CBN and SEC.

Pro Account Requirements for Nigerians

The minimum deposit is ₦65,000 (~$100). To open:

- Complete KYC verification with ID and proof of residence, as required by the SEC.

- In the Personal Area, select “Open New Account” and choose Pro.

- Deposit ₦65,000 via bank transfer or domestic accounts with Access Bank, GTBank, or others.

Spreads start at 0.1 pips with no commissions, and leverage reaches 1:2000. Test the Pro account in demo mode first, as its speed suits active strategies like day trading.

Demo Account: Practice Without Risk

The Demo account allows Nigerian traders to practice without financial risk, ideal for testing strategies or platforms in compliance with CBN regulations.

How to Open a Demo Account

A demo account is created automatically during registration with $10,000 in virtual funds. To set it up manually:

- Log into the Personal Area and click “Open New Account.”

- Select “Demo” and choose an account type (e.g., Standard, Pro).

- Log into MT4, MT5, or Web Terminal with demo credentials in English, Hausa, Yoruba, or Igbo.

The demo mirrors real market conditions. Use it to practice risk management and test account types. It expires after 30 days of inactivity, so trade regularly.

Account Type Comparison Table

Exness offers account types tailored for over 200,000 active Nigerian traders, each suited to different experience levels and trading styles. The table below summarizes key features to help you choose. Practice with a demo account for each type to test features before depositing real funds.

| Account Type | Minimum Deposit | Spreads (Pips) | Commission (Per Lot/Side) | Leverage | Best For |

|---|---|---|---|---|---|

| Standard | ₦3,000 (~$5) | From 0.3 | None | Up to 1:2000 | Beginners, casual traders |

| Standard Cent | ₦3,000 (~$5) | From 0.3 | None | Up to 1:2000 | Micro-trading, new traders |

| Raw Spread | ₦65,000 (~$100) | From 0.0 | Up to $3.50 | Up to 1:2000 | Active traders, scalping |

| Zero | ₦65,000 (~$100) | 0 (95% of time) | Varies (some pairs free) | Up to 1:2000 | Scalpers, major pairs |

| Pro | ₦65,000 (~$100) | From 0.1 | None | Up to 1:2000 | Experienced traders |

| Social Standard | ₦150,000 (~$250) | From 0.3 | None | Up to 1:2000 | Copy trading, beginners |

| Social Pro | ₦600,000 (~$1,000) | From 0.1 | None | Up to 1:2000 | Advanced copy trading |

All accounts support NGN as a base currency to avoid conversion fees and offer swap-free options for Islamic traders. Spreads and commissions vary with market conditions, so check real-time costs in the Personal Area. Use a demo account to compare performance with your preferred markets, like forex or gold, in compliance with CBN and SEC regulations.

How to Choose the Right Account Type

Selecting the best Exness account for Nigerian traders depends on your experience, budget, and goals. Beginners should start with the Standard or Standard Cent account—both require just ₦3,000 (~$5) with no commissions, ideal for learning forex or testing strategies with minimal risk. The Standard Cent is great for micro-trading, allowing tiny lots to manage risk. Experienced traders may prefer the Pro or Raw Spread accounts for tighter spreads (from 0.1 or 0.0 pips) and faster execution, though the ₦65,000 (~$100) deposit and potential commissions on Raw Spread require more capital.

Scalpers should consider the Zero account for its 0-pip spreads on major pairs like EUR/USD, but monitor commissions on some instruments. For copy trading, the Social Standard (₦150,000) or Social Pro (₦600,000) accounts allow following experienced traders, though they’re costlier. Always match the account to your funds—don’t stretch to a ₦65,000 account if unprepared for larger trades. Test each account type in a demo environment to evaluate spreads, leverage, and execution with your strategy, using platforms in English, Hausa, Yoruba, or Igbo. For example, try scalping on a Zero demo during the London session or micro-trading on a Cent demo with USD/JPY. Review your trading plan regularly to ensure the account fits your needs, and start with small deposits to minimize risk while complying with FEMA and CBN regulations.

Forex Trading with Low & Stable Spreads

Trade global forex with low spreads and superior conditions for better results, maximizing your potential with each trade.

Frequently Asked Questions

What are the different types of Exness accounts available in Nigeria?

Exness offers various account types, including the Standard Account, Professional Account, Zero Account, and ECN Account. Each has unique features like spreads, commissions, and leverage options, catering to both beginners and experienced Nigerian traders, regulated by the CBN and SEC.