Introduction to Cryptocurrency Trading

Cryptocurrency trading has evolved into a mainstream financial activity, with Bitcoin at the center of this digital movement. Traders now seek platforms that offer reliable execution, flexible conditions, and transparent pricing. Exness provides access to cryptocurrency markets through CFDs (contracts for difference), enabling users to speculate on price movements without directly owning digital coins.

Trading crypto CFDs comes with the advantage of leverage and the flexibility to go long or short. This means traders can attempt to profit whether prices rise or fall. However, due to volatility, managing exposure is crucial.

Unlike traditional crypto exchanges, which often involve wallet security and transaction delays, a CFD platform like Exness enables swift execution and integrated risk controls. For traders who prioritize speed, cost-efficiency, and simplicity, this setup is a practical alternative.

Available Crypto Pairs on Exness

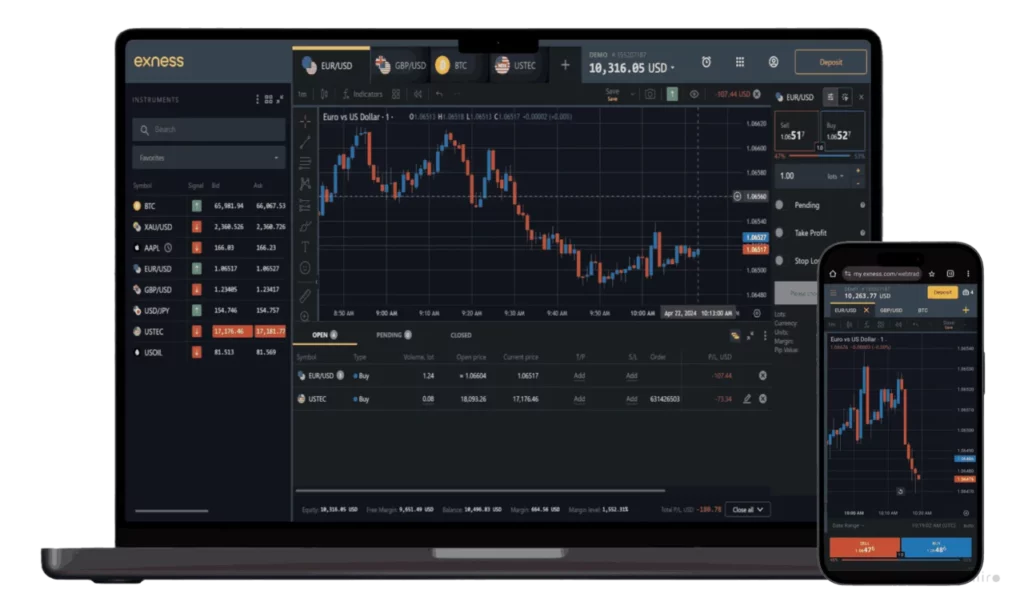

Exness offers a diverse range of cryptocurrency pairs, including major Bitcoin crosses, altcoin combinations, and crypto-to-fiat instruments. These pairs are accessible through the MetaTrader 4 platform and the Exness Trade app, ensuring availability across both desktop and mobile devices.

BTC/USD and Other Bitcoin Pairs

Bitcoin remains the most traded cryptocurrency, and Exness offers several pairs that include BTC as the base or quote currency. The most active among these is BTC/USD, favored for its liquidity and tight spreads.

Additional BTC-related pairs include:

- BTC/EUR

- BTC/JPY

- BTC/THB

- BTC/KRW

- BTC/USDT

Each pair reflects demand across various global markets and allows for tailored strategies depending on regional trends and macroeconomic developments.

Other Cryptocurrencies Available

Besides Bitcoin, the platform lists many popular altcoins as CFDs. These include:

- Ethereum (ETH/USD, ETH/BTC)

- Litecoin (LTC/USD)

- Ripple (XRP/USD)

- Bitcoin Cash (BCH/USD)

- Dogecoin (DOGE/USD)

- Cardano (ADA/USD)

The selection enables traders to explore relative strength strategies, hedge existing positions, or take advantage of momentum in trending altcoins.

How to Find Crypto Pairs on the Platform

To access the full list of cryptocurrency pairs on MetaTrader 4:

- Open the Market Watch window.

- Right-click and select Symbols.

- Choose the Crypto or CryptoCross categories.

- Double-click the desired instrument to activate it.

These pairs can then be added to charts for analysis or placed directly into orders for execution.

Trading Conditions for Bitcoin

Trading Bitcoin through Exness offers a streamlined experience that emphasizes flexibility and efficiency. Conditions are designed to accommodate a range of trading styles, from high-frequency strategies to longer-term positions. Understanding the platform’s key trading parameters helps in building a solid execution plan.

Leverage for BTC/USD Trading

Exness offers variable leverage for cryptocurrency CFDs, including BTC/USD. The maximum available leverage depends on the account type and equity balance. For retail accounts, leverage is limited to ensure a balanced risk profile due to the high volatility of cryptocurrencies.

The leverage structure may look like this:

| Account Equity (USD) | Maximum Leverage on BTC/USD |

|---|---|

| 0 – 999 | Up to 1:200 |

| 1,000 – 4,999 | Up to 1:100 |

| 5,000 – 29,999 | Up to 1:50 |

| 30,000 and above | Up to 1:20 |

Traders should monitor their equity regularly, as margin requirements may automatically adjust depending on account size and market volatility. Using adjustable leverage allows for better alignment with personal risk strategies.

Spreads and Fees for Bitcoin

Trading costs on Bitcoin CFDs are determined primarily by the spread—the difference between the bid and ask prices. On Exness, BTC/USD spreads are variable, starting from low values under normal market conditions. However, these can widen during periods of high volatility, reduced liquidity, or major market events.

Here’s a general breakdown of cost considerations:

| Account Type | Typical Spread on BTC/USD | Commission |

|---|---|---|

| Standard | From 1.5 to 3.0 USD | None |

| Raw Spread | From 0.0 USD | Yes |

| Zero | Fixed at 0.0 USD | Yes |

Spreads fluctuate in real-time, so it’s essential to check the current rates directly from the trading terminal. Swap fees may also apply for overnight positions unless the instrument is classified as swap-free under specific account conditions.

Trading Hours for Bitcoin

One of the most attractive features of trading Bitcoin CFDs is market availability. Unlike traditional markets, cryptocurrency trading on Exness is open 24 hours a day, 7 days a week—including weekends.

| Instrument | Trading Hours (UTC+0) |

|---|---|

| BTC/USD | 00:00 Mon – 23:59 Sun |

| BTC/Alt | Continuous (with minor gaps) |

This around-the-clock access gives traders the freedom to act on price movements at any time, especially useful for those following global events or managing positions across multiple time zones.

Getting Started with Bitcoin Trading

Starting out with Bitcoin trading on Exness is straightforward. The platform is designed to offer access to crypto CFDs without unnecessary steps, but there are important settings and configurations that every trader should pay attention to before entering the market.

Setting Up a Trading Account

To begin trading Bitcoin, a user must first create a trading account through the Exness website or mobile app. The process typically involves:

- Registration: Submit a valid email and create a password.

- Verification: Upload identification documents and proof of residence.

- Account Selection: Choose from account types such as Standard, Raw Spread, or Zero.

- Funding the Account: Deposit funds using available payment systems—bank transfers, electronic wallets, or cryptocurrencies.

Once the account is verified and funded, traders can access MetaTrader 4 or the Exness Trade app to begin trading.

To access Bitcoin CFDs:

- Go to Market Watch in MetaTrader.

- Click Symbols > Crypto.

- Choose BTC/USD or another Bitcoin-related pair.

- Double-click to enable the instrument for charting and trading.

It’s also possible to switch between real and demo accounts, which can be useful for testing strategies in a simulated environment before trading live funds.

Risk Management for Crypto Trading

Bitcoin’s volatility makes risk management an essential part of trading. Unlike traditional assets, crypto prices can shift dramatically in a short span of time. Using tools and rules helps reduce exposure to unexpected market movements.

Key risk practices include:

- Set Stop Loss Orders: Define a maximum acceptable loss per trade.

- Use Take Profit Levels: Lock in gains at predefined price targets.

- Limit Leverage Use: Avoid overexposure by choosing conservative leverage ratios.

- Position Sizing: Adjust trade volume according to account balance and risk tolerance.

- Diversify Instruments: Avoid concentrating risk on a single position.

An example risk-per-trade formula:

Risk = Account Balance x Risk Percentage per Trade

If trading with a $1,000 balance and risking 2% per trade:

$1,000 x 0.02 = $20 maximum loss per trade

This approach ensures that no single trade can wipe out the account, even in fast-moving markets.

Tips for Successful Bitcoin Trading

Bitcoin trading offers opportunities, but it also comes with high volatility and unpredictable price behavior. Traders who succeed often follow consistent processes and avoid impulsive decisions. Here are some practical tips to approach Bitcoin trading with more discipline and structure.

Follow the Market, Not the Noise: Market sentiment plays a big role in cryptocurrency movements. But not every headline is worth reacting to. Focus on clear price signals, volume patterns, and long-term trends rather than reacting emotionally to news stories or social media speculation.

Use Technical Analysis: Bitcoin charts often follow repeatable patterns. Technical tools can help identify these movements:

- Moving Averages help identify trends.

- RSI (Relative Strength Index) shows overbought or oversold conditions.

- Fibonacci Retracements can highlight potential support and resistance zones.

- MACD (Moving Average Convergence Divergence) shows momentum changes.

Use indicators selectively. Overloading charts with multiple tools often leads to confusion. It’s more effective to master a few indicators and use them consistently.

Keep a Trading Journal: Document every trade:

- Entry and exit prices.

- Time of execution.

- Reason for trade.

- Result (profit or loss).

- Emotional state.

Reviewing past trades helps refine strategy and reduce repeated mistakes. Over time, patterns in behavior and decision-making become clearer.

Avoid Overtrading: Bitcoin’s round-the-clock market can tempt traders to enter positions too frequently. This often leads to emotional decisions and account drawdowns. Instead:

- Stick to planned setups.

- Set daily or weekly limits on the number of trades.

- Take breaks to avoid fatigue.

Use Weekend Trading Strategically: Exness offers 24/7 crypto trading, including weekends. Price gaps and volume shifts can occur during this time. Traders can:

- Capture weekend momentum.

- Close open positions by Sunday night to avoid Monday volatility.

- Use pending orders to catch unexpected moves.

This flexibility can be helpful but requires extra caution due to thinner liquidity and wider spreads during low-activity periods.

Frequently Asked Questions

What is the minimum deposit to start trading Bitcoin on Exness?

There is no fixed minimum deposit for most account types. However, technical limits may apply based on the payment method. For practical purposes, a deposit of $10 or more is generally required to activate a trading account and place a position.