Overview of Exness in Nigeria

Exness is a widely known forex and CFD broker with growing popularity among Nigerian traders. Operating globally since 2008, the company has steadily expanded its presence in emerging markets, including Nigeria, where traders are increasingly seeking transparent and efficient trading platforms. With local payment methods, high-leverage options, and competitive spreads, the broker has positioned itself as a practical choice for both beginners and experienced traders looking for reliable execution and access to global markets.

Why Nigerian Traders Choose Exness

Traders in Nigeria have several reasons for selecting Exness as their broker of choice. Among the most frequently cited factors are:

- Instant withdrawals: Nigerian clients value the ability to move funds quickly, and Exness supports local payment solutions with fast processing times.

- Flexible leverage: Leverage settings can be adjusted, including access to very high leverage for experienced traders.

- No hidden fees: There are no deposit or withdrawal fees on most payment methods, and commissions are clearly stated where applicable.

- Diverse instruments: Clients can access a wide range of trading instruments including forex, metals, indices, cryptocurrencies, and energies.

- User-friendly platforms: MetaTrader 4 and MetaTrader 5 are available on desktop, mobile, and web interfaces, making trading accessible anytime.

Other common reasons include:

- Support in English and local languages.

- Comprehensive educational resources and webinars.

- Access to real-time economic news feeds.

- Transparent pricing and fast order execution.

These features make the platform suitable for Nigerian traders who seek efficiency and control without compromising on features or reliability.

Legal Status and Regulation

Exness operates under multiple licenses from reputable financial authorities worldwide. While the broker is not directly licensed by the Nigerian Securities and Exchange Commission (SEC), it is authorized and regulated by several other entities that oversee its operations in international jurisdictions.

The company serves Nigerian clients primarily through Exness (SC) Ltd, regulated by the Financial Services Authority (FSA) of Seychelles. This entity operates in compliance with international standards regarding fund safety and financial practices.

Other Exness group entities are also regulated by authorities such as:

- Financial Conduct Authority (FCA) in the UK.

- Cyprus Securities and Exchange Commission (CySEC).

- Capital Markets Authority (CMA) in Kenya.

- Financial Sector Conduct Authority (FSCA) in South Africa.

While not Nigeria-specific, this regulatory framework gives Nigerian traders access to a broker that adheres to global standards for client fund segregation, transaction transparency, and audit compliance.

Real Exness Reviews from Nigerian Traders

Overall, the sentiment among Nigerian users reflects a broker that delivers consistency in areas that matter most — reliability, speed, and cost transparency. Many traders highlight how Exness has improved their trading workflow by offering stable platform access and uninterrupted trading sessions, even during high market activity. This reliability, paired with accessible account setup and localised service, reinforces the broker’s growing reputation across the Nigerian trading community.

Positive User Experiences

Among Nigerian traders, Exness is frequently praised for its platform stability, efficient withdrawal processing, and straightforward onboarding.

Many users mention that account setup is quick, requiring only a few basic verification steps, and the trading platforms — especially MetaTrader 4 — are intuitive even for those with limited experience.

Here are a few recurring points highlighted by traders in Nigeria:

- Fast deposits and withdrawals: Most transactions via local bank transfers or e-wallets are processed within minutes, even during weekends.

- Transparent conditions: Traders appreciate that spreads, swaps, and commissions are clearly listed in the trading platform or Exness website.

- Responsive customer service: Support is available 24/7, and users often mention that assistance is helpful and quick to resolve issues.

- Low minimum deposit: The ability to start trading with as little as $10 or its local equivalent appeals to many retail traders.

Some users also value the availability of multiple account types, including the Standard Cent account, which is popular for testing strategies in a lower-risk environment.

Common Complaints and Issues

While the majority of reviews are favorable, Nigerian traders have voiced a few concerns as well. These are not unique to Nigeria but do surface in local discussions and forums:

- Server delay during volatile hours: Some users mention minor slippage or order delays during periods of high market volatility.

- Verification issues: A few traders have encountered delays in the account verification process, usually due to document rejection or discrepancies.

- Restricted instrument access: Depending on the account type and server region, some users report limited access to specific trading pairs or assets.

- Leverage adjustments: High leverage may not be available for all account types or instruments, depending on trading volume and equity.

These issues tend to be situational and often resolved through support channels, but it’s important for prospective users to be aware of them.

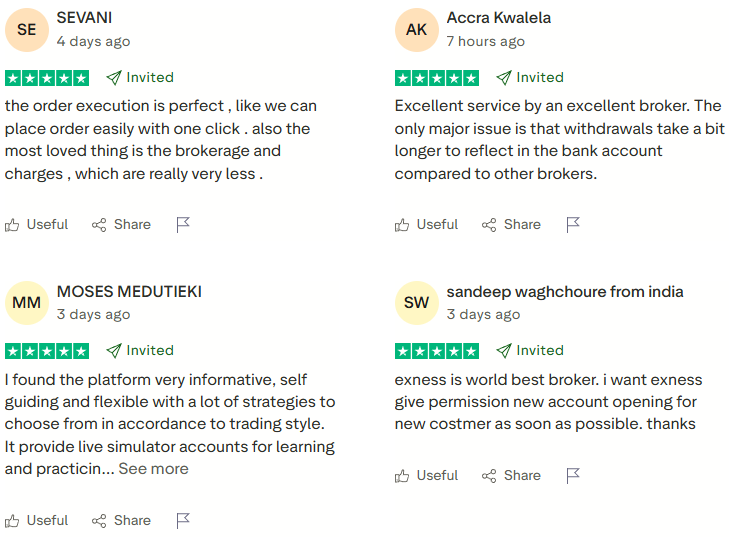

Trustpilot and Online Reviews Analysis

A broader look at third-party review platforms provides additional context. On Trustpilot, Exness holds a generally positive score with a large volume of reviews. Nigerian traders contribute actively, often praising:

- Fast execution and pricing accuracy.

- Accessibility of funds.

- Clear fee structures.

At the same time, negative reviews are often tied to misunderstandings around trading rules (e.g., swap charges or margin calls), rather than platform malfunctions or service failures.

Online trading forums such as Nairaland and Quora also show a mix of experiences. Threads discussing Exness in Nigeria often reveal that while some users face technical challenges, the majority acknowledge that the broker is consistent and professional.

Summary of review trends:

| Area of Review | General Sentiment | Remarks |

| Withdrawals | Highly positive | Instant processing for local bank and e-wallets |

| Platform performance | Mostly positive | Minor issues reported during peak hours |

| Support | Positive | Quick replies and availability in multiple languages |

| Pricing | Positive | Tight spreads; commission structure understood |

| Verification | Mixed | Some rejections due to non-matching documents |

Is Exness Legit?

The combination of regulatory coverage and operational safeguards positions Exness as a broker that prioritizes accountability. For Nigerian traders, this means engaging with a platform that complies with internationally recognized standards for financial conduct, even without a local Nigerian license. The availability of clear documentation, verifiable licenses, and secure handling of client funds contributes to a level of transparency that helps build trust.

License Verification and Fund Security

The legitimacy of Exness is a recurring topic among Nigerian traders, especially those new to the forex industry. One of the most important aspects in determining a broker’s credibility is its regulatory status. Exness operates under multiple licenses issued by trusted financial authorities across several regions.

The entity that serves most Nigerian clients is Exness (SC) Ltd, which is regulated by the Financial Services Authority (FSA) of Seychelles. This license requires the company to maintain operational transparency and follow specific financial standards, including segregation of client funds and regular audits.

Other regulatory approvals include:

| Regulatory Body | Entity Name | Region | License Number |

| FSA | Exness (SC) Ltd | Seychelles | SD025 |

| CySEC | Exness (Cy) Ltd | Cyprus (EU) | 178/12 |

| FCA | Exness (UK) Ltd | United Kingdom | 730729 |

| FSCA | Exness ZA (Pty) Ltd | South Africa | 51024 |

| CMA | Exness (KE) Ltd | Kenya | 162 |

| CBCS | Exness B.V. | Curaçao and Sint Maarten | 0003LSI |

Trading Experience Review

Exness gives Nigerian traders the flexibility to adapt their trading environment to suit evolving strategies and market conditions. Whether starting with small capital or managing multiple portfolios, the variety of account types and platform integrations allows users to scale as needed. Beginners often start with Standard Cent accounts for lower risk, while experienced traders migrate to Pro or Raw Spread accounts for tighter control over spreads and execution speed.

Platforms and Account Types

Exness provides access to a full suite of trading platforms, tailored to meet the needs of different trading styles and skill levels. The most widely used platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — both of which are available on desktop, mobile, and browser-based versions.

MetaTrader 4 (MT4): MT4 remains a favorite among Nigerian traders due to its simplicity and reliability. It supports algorithmic trading via Expert Advisors (EAs), multiple charting tools, and fast execution. It also offers:

- One-click trading.

- Real-time market data.

- 30+ built-in indicators and customizable scripts.

MetaTrader 5 (MT5): For those who require more analytical tools, MT5 expands on MT4 with:

- More timeframes and technical indicators.

- Integrated economic calendar.

- Depth of market view.

- Enhanced order types.

Additionally, Exness offers a MultiTerminal platform (Windows only), allowing account managers to operate multiple MT4 accounts from a single interface — an option particularly useful for prop traders and money managers.

Available Account Types:

| Account Type | Spread (from) | Commission | Minimum Deposit | Execution | Platforms |

| Standard | 0.3 pips | None | No minimum | Market | MT4/MT5 |

| Standard Cent | 0.3 pips | None | No minimum | Market | MT4 only |

| Pro | 0.1 pips | None | Varies | Market | MT4/MT5 |

| Zero | 0.0 pips | From $0.2/lot | Varies | Market | MT4/MT5 |

| Raw Spread | 0.0 pips | From $3.5/lot | Varies | Market | MT4/MT5 |

Spreads, Fees, and Execution Speed

Exness is known for offering competitive spreads across major and minor currency pairs. For example:

- EUR/USD spread on a Standard account typically starts at 0.3 pips

- On Raw Spread or Zero accounts, the spread can be as low as 0.0 pips, particularly during peak liquidity hours

Here’s a sample of typical spreads:

| Instrument | Standard Account | Zero Account | Raw Spread Account |

| EUR/USD | ~0.3 – 1.0 pips | 0.0 pips | 0.0 pips + $3.5/lot |

| GBP/USD | ~0.6 – 1.2 pips | 0.1 pips | 0.0 pips + $3.5/lot |

| XAU/USD | ~10 – 30 points | 5 points | 5 points + $3.5/lot |

Exness invests heavily in execution infrastructure. Most orders are filled in milliseconds, reducing slippage risk even during volatile market events. According to internal performance benchmarks, Exness processes orders using advanced order-routing systems that prioritize speed and pricing consistency.

Order types supported:

- Instant and Market Execution.

- Pending Orders: Buy Limit, Sell Limit, Buy Stop, Sell Stop, Buy Stop Limit, Sell Stop Limit.

Exness also includes Stop Out Protection, a mechanism that delays the liquidation of positions when margin is running low — minimizing premature closures caused by temporary volatility.

Frequently Asked Questions

Is Exness available for traders in Nigeria?

Yes. Exness accepts clients from Nigeria and provides services tailored to the region, including local deposit options, flexible leverage, and access to trading in naira through currency conversion. Traders can open accounts, verify identities, and fund their wallets using bank transfers or e-wallets commonly used in Nigeria.