Understanding Exness Commission Structure

Exness operates under a cost model designed to suit traders of all levels, offering accounts with different pricing schemes. Rather than a one-size-fits-all system, the broker provides a mix of spread-based accounts and commission-based accounts. This flexibility allows traders to choose a setup that aligns with their trading volume, style, and risk management needs.

Trading fees at Exness typically fall into three categories:

- Spreads: The difference between the bid and ask price of a financial instrument.

- Commissions: Charged per traded volume, depending on account type.

- Swap or rollover fees: Applied for holding positions overnight on certain instruments.

Some accounts are spread-only with no fixed commission, while others feature tighter spreads but apply a commission per lot traded. The choice of account type significantly affects the overall cost of trading.

Types of Fees Charged

Exness fees are either built into the spread or charged as separate commissions. Below are the most common charges traders should account for:

- Spreads: These vary depending on the instrument and account type. On standard accounts, spreads are wider to cover broker costs.

- Commission Per Lot: Raw Spread and Zero accounts apply a fixed commission, often per $1 million traded, but vary by instrument.

- Swap Fees: Also known as overnight or rollover fees, these are interest charges on positions held open after the trading day ends.

- Currency Conversion Costs: When trading in instruments priced in a currency different from the account’s base currency, conversion may apply.

- Inactivity Fees: Not charged by Exness currently, but traders should regularly check the latest conditions in their Personal Area.

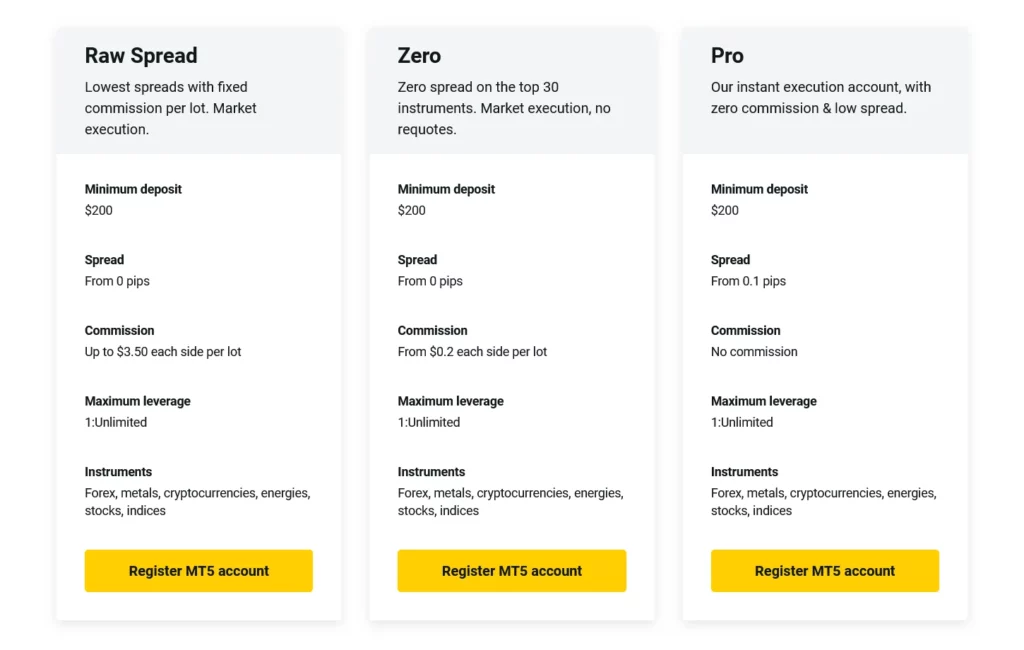

Comparison of Account Types

Choosing the right account type affects how much a trader pays in fees. Exness provides a mix of standard and professional accounts to match varying experience levels and strategies. Each account has its own structure for spreads, commissions, and margin requirements.

| Account Type | Spread From (Pips) | Commission | Minimum Deposit | Execution Type |

| Standard | 0.3 | None | No Minimum | Market Execution |

| Standard Cent | 0.3 | None | No Minimum | Market Execution |

| Raw Spread | 0.0 | From $3.5 per lot | From $200 | Market Execution |

| Zero | 0.0 | From $0.2 per lot | From $200 | Market Execution |

| Pro | 0.1 | None | From $200 | Market Execution |

Standard Account Fees

The Standard and Standard Cent accounts are ideal for casual or new traders. There are no commission charges, and the broker’s revenue is included in the spread. This makes the cost structure simple but potentially higher during volatile periods when spreads widen.

These accounts allow small trade sizes, with the Standard Cent offering positions as low as 0.01 cent lots. This is particularly useful for testing strategies or practicing risk management with limited capital.

Professional Account Fees

Professional accounts – Pro, Raw Spread, and Zero – are designed for more active traders. These accounts offer tighter spreads and lower latency execution.

- Pro Account: No commission, and spreads start from 0.1 pip. It’s suited for traders wanting institutional-grade conditions without additional charges per trade.

- Raw Spread Account: Spreads start from 0.0 pips. Commission is charged per lot – usually $3.5 per side ($7 round trip) for forex. This account is optimal for high-frequency traders.

- Zero Account: Ultra-low spreads on key instruments like EURUSD and XAUUSD. Commission starts from $0.2 per lot but can vary by instrument. This model suits traders who focus on low-cost entries.

Trading Costs for Nigerian Traders

Traders in Nigeria benefit from Exness’ localized payment options, instant withdrawals, and competitive trading conditions. However, it’s essential to consider how core trading costs—spreads, swap fees, and commissions—affect trading profitability over time.

Spreads and Their Impact

Spreads are a primary cost in forex and CFD trading. On the Standard account, spreads begin from 0.3 pips, but actual values depend on market volatility and instrument liquidity.

For example, the spread on EURUSD may average 1 pip on Standard accounts, while Raw Spread accounts may offer the same instrument at nearly 0.0 pips, with an added commission.

Estimated Spread Cost Example (per lot):

| Instrument | Account Type | Typical Spread | Cost in USD (1 lot) |

|---|---|---|---|

| EURUSD | Standard | 1.0 pip | $10 |

| EURUSD | Raw Spread | 0.1 pip | $1 |

| EURUSD | Zero | 0.0 pip | $0 + commission |

This illustrates how lower spreads can significantly reduce trading expenses, particularly for frequent traders or scalpers.

Overnight Swap Fees

Swap fees apply when a position remains open beyond market close. These charges vary by instrument and can be either positive or negative depending on the direction of the trade and interest rate differentials.

For Nigerian traders trading major forex pairs or gold, swaps can accumulate quickly. Exness offers swap-free trading on many instruments for extended periods or permanently in specific regions, including Nigeria.

Example: Overnight Swap Fees for 1 Lot (Illustrative Only):

| Instrument | Long Swap (USD) | Short Swap (USD) |

|---|---|---|

| EURUSD | -5.32 | 3.25 |

| XAUUSD | -9.85 | -7.45 |

| BTCUSD | -30.10 | -30.10 |

Swap rates are updated daily and can be checked in the platform or Personal Area. Managing these costs is key for those who hold trades overnight or run swing strategies.

Using a Trading Cost Calculator

Understanding potential costs before opening a trade can help traders avoid surprises. This is where trading calculators come in handy. Exness offers tools to estimate the cost of a trade based on volume, instrument, and leverage.

How to Access a Cost Calculator

The trading calculator is accessible via the broker’s website or through the Personal Area. No login is required to use the tool.

Steps to access:

- Go to the Exness official website.

- Scroll to the “Tools” section.

- Select “Trading Calculator”.

- Choose your trading instrument, account type, volume, leverage, and currency.

The output includes margin requirements, pip value, swap fees, and spread costs—helping traders plan trades with precision.

Estimating Costs for Trades

Using the calculator, a trader can input a scenario such as:

- Instrument: GBPUSD.

- Account type: Raw Spread.

- Volume: 1 lot.

- Leverage: 1:500.

- Currency: USD.

Estimated result:

- Margin required: $240.00.

- Pip value: $10.00.

- Spread cost: $1.00 (0.1 pip).

- Commission: $7.00 (round-trip).

- Swap: -$4.50 (if held overnight).

These figures allow the trader to evaluate total cost and make a decision before executing the trade. Tools like this help eliminate uncertainty and reinforce consistent risk management.

Frequently Asked Questions

Does Exness charge a commission on all account types?

No. Commission fees are only charged on Raw Spread and Zero accounts. Standard and Pro accounts operate on a spread-only pricing model, meaning the broker’s cost is included in the spread.