- Maximum Leverage Options

- Standard Accounts: 1:2000

- Professional Accounts: 1:Unlimited

- Exness Unlimited Leverage Rules

- Eligibility Requirements

- Equity Restrictions

- Exness Leverage Calculator

- Dynamic Leverage System

- Exness Leverage by Instrument

- Forex Pairs

- Metals & Commodities

- Cryptocurrency

- Risk Management

- Stop Out Levels

- Margin Call Process

- Frequently Asked Questions

Maximum Leverage Options

Exness features some of the most flexible leverage options in the industry. These factors are affected by the kind of account, the instrument, and the quantity of equity. The highest leverage available is 1:Unlimited, but traders must meet certain conditions to receive this option.

Standard Accounts: 1:2000

Most traders with regular accounts can utilize up to 1:2000 leverage. This means that a trader with $100 in equity can make trades for up to $200,000. Some common kinds of accounts are:

- Standard.

- Standard Cent.

To open a Standard or Standard Cent account, you need to deposit at least $10, and there are no fees for trading. With a leverage of 1:2000, margin requirements are lower, which means you can get more exposure to the market without having to put in more money.

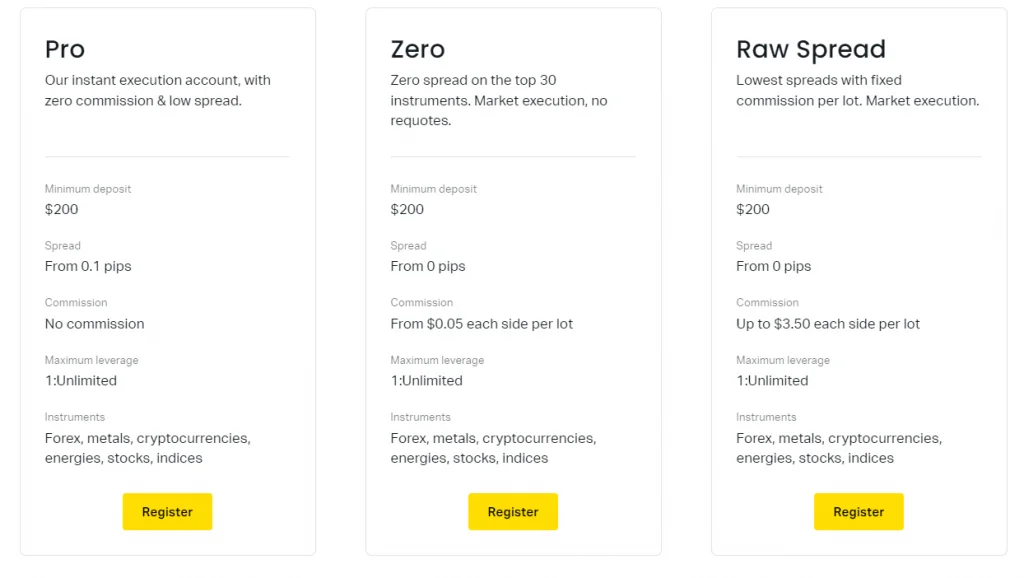

Professional Accounts: 1:Unlimited

Professional accounts – Pro, Raw Spread, and Zero – can use unlimited leverage, which means that most positions don’t need to have a margin requirement. Traders that choose this amount of leverage frequently use short-term, high-frequency methods and have to meet higher eligibility requirements.

This choice came out in 2016 and was a big change in the industry. Back then, most brokers let you borrow up to 500 times your own money. Exness raised this restriction in response to more traders asking for it. It went from 1:1000 to 1:2000, and finally to no limit at all.

Exness Unlimited Leverage Rules

The idea of unlimited leverage is appealing, but it comes with severe rules that must be followed. These regulations are in place to lower systemic risk and keep accounts stable when things are unstable.

Eligibility Requirements

To qualify for unlimited leverage, the account must meet all of the following conditions:

- Account type: Must be either Pro, Raw Spread, or Zero.

- Trading volume: A minimum number of closed trades is required.

- Lot size: Traders must close at least 10 positions totaling 5 standard lots or more.

- Duration: Only trades held for more than 2 minutes count toward this requirement.

Once these conditions are met, Exness enables the unlimited leverage setting on the eligible account. Traders can manually activate or adjust the leverage from their Personal Area.

Equity Restrictions

Unlimited leverage is not always available. It becomes automatically limited based on the equity level in a trader’s account:

| Equity (USD) | Maximum Leverage Allowed |

| $0–999 | 1:Unlimited |

| $1,000–4,999 | 1:2000 |

| $5,000–14,999 | 1:1000 |

| $15,000–29,999 | 1:600 |

| $30,000+ | 1:200 |

These restrictions are enforced in real time. For example, if a trader’s account equity increases from $950 to $1,050, leverage is automatically adjusted from unlimited to 1:2000.

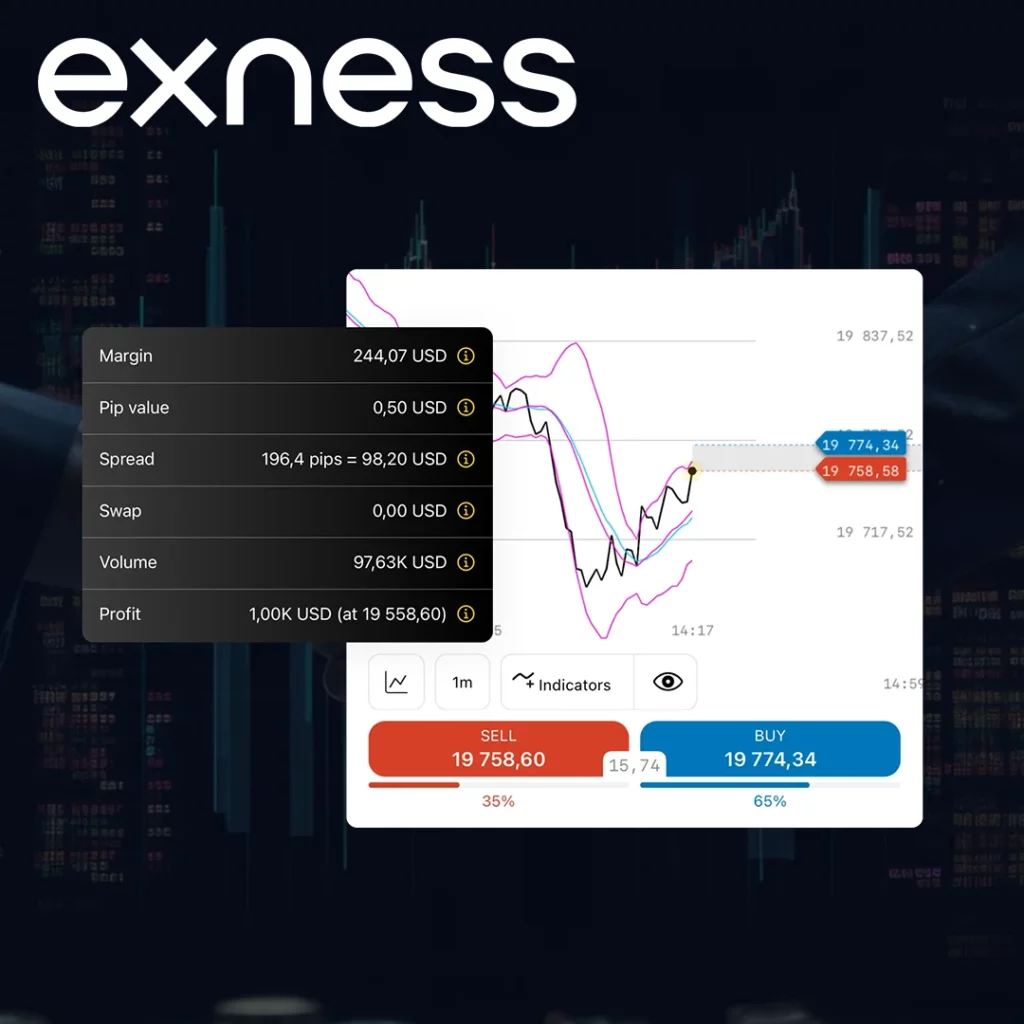

Exness Leverage Calculator

To help with accurate planning and position sizing, Exness offers a leverage calculator directly accessible through the Personal Area or trading tools section. This tool simplifies the calculation of required margin and potential exposure based on current account settings.

The calculator requires four inputs:

- Instrument (e.g., EURUSD, XAUUSD).

- Lot size.

- Leverage setting.

- Account currency.

The output provides the margin required per position, which allows traders to adjust volume accordingly. For instance, trading 1 lot of EURUSD (100,000 units) at 1:500 leverage requires approximately $200 in margin. With 1:Unlimited, the margin required drops to virtually zero, subject to platform conditions and execution settings.

The calculator helps:

- Avoid margin calls.

- Plan entry sizes.

- Simulate different leverage tiers.

It’s a practical tool, especially when trading across multiple instruments with varying margin requirements.

Dynamic Leverage System

Exness implements a dynamic leverage model. This means that the maximum leverage available adjusts based on trading volume, account equity, and market conditions. The idea is to reduce systemic risk as exposure increases.

The leverage starts at the highest possible level (e.g., 1:Unlimited or 1:2000), then scales down automatically as open positions grow.

Here’s a general outline of how this scaling works:

| Total Position Volume (USD) | Maximum Leverage |

| 0–5 million | 1:Unlimited |

| 5–20 million | 1:2000 |

| 20–50 million | 1:1000 |

| 50–100 million | 1:500 |

| 100 million+ | 1:200 |

This adjustment is performed instantly by the platform. There’s no need for manual input, but traders should monitor their volume to understand when the leverage is being scaled back.

Dynamic leverage is most relevant for large-volume traders, particularly those with institutional-style strategies or holding positions across multiple symbols.

Exness Leverage by Instrument

Not all instruments are eligible for the same leverage level. Exness categorizes instruments based on asset class, and each category has a predefined leverage cap based on liquidity, volatility, and trading hours.

Forex Pairs

Exness supports more than 100 forex pairs, including majors, minors, and exotics. Leverage for currency pairs is typically:

| Pair Type | Max Leverage |

| Majors | Up to 1:Unlimited |

| Minors | Up to 1:2000 |

| Exotics | Up to 1:500 |

Major pairs like EURUSD, GBPUSD, and USDJPY are eligible for the highest leverage, including the unlimited tier when account equity permits. Exotic pairs like USDTRY or USDZAR carry higher volatility and are capped to maintain risk controls.

Metals & Commodities

Precious metals and energy products offer high volatility but are more constrained in terms of leverage:

| Instrument | Max Leverage |

| Gold (XAUUSD) | 1:2000 |

| Silver (XAGUSD) | 1:2000 |

| Platinum, Palladium | 1:1000 |

| Crude Oil (USOIL) | 1:500 |

| Natural Gas (XNGUSD) | 1:500 |

Leverage for commodities such as oil and gas is often dynamic depending on market liquidity and contract specifications.

Cryptocurrency

Leverage on crypto pairs is significantly lower due to the extreme price volatility and weekend trading hours:

| Crypto Pair | Max Leverage |

| BTCUSD | 1:400 |

| ETHUSD | 1:200 |

| LTCUSD | 1:100 |

| Cross Pairs (e.g., BTCAUD) | 1:100 |

Although leverage is capped, Exness offers tight spreads and zero overnight fees on many crypto instruments. These conditions aim to compensate for the lower leverage range.

Risk Management

When you use leverage, you can make bigger profits, but you also take on more risk. Exness has a number of automated tools in place to help traders manage their risk, avoid liquidation, and stay up to date during times of high volatility. If you want to avoid having to close positions you didn’t plan to, you need to know how margin calls and stop outs work.

Stop Out Levels

Exness uses a 0% stop out level across all account types. This means that positions are automatically closed when margin level falls below 0%.

Example:

- A trader opens a 1-lot EURUSD position with a margin of $100.

- If the account equity drops to $0 due to an unfavorable price move, the system closes open positions automatically.

This zero-margin liquidation point helps traders stay in the market longer. It’s especially effective during temporary market reversals where recovery is likely, but margin would otherwise be insufficient.

Some exceptions exist for stock CFDs, especially during market breaks, where the stop out level can temporarily increase to 100% for specific account types.

Margin Call Process

A margin call is triggered when the margin level reaches 60%. This is a warning signal, not an automatic action. At this stage:

- Traders receive a notification inside the terminal.

- No forced closures occur yet.

- It acts as a prompt to reduce volume or add funds.

Margin Level Formula:

\text{Margin Level (%) = (Equity / Used Margin) × 100}

At 60%, traders may choose to:

- Close some positions.

- Add funds to increase equity.

- Hedge open positions.

Failure to act before the margin level hits 0% will result in automatic closure starting from the least profitable order.

These thresholds are fixed across all accounts:

- Margin call: 60%

- Stop out: 0%

Both are non-adjustable and enforced in real time.

Frequently Asked Questions

What is the maximum leverage available at Exness?

Exness offers up to 1:Unlimited leverage on Pro, Raw Spread, and Zero accounts. Standard accounts have a maximum leverage of 1:2000, subject to equity thresholds.