Minimum Deposit by Account Type

Exness provides five main account types: Standard, Standard Cent, Raw Spread, Zero, and Pro. Each has a technical minimum deposit limit, typically set by the payment system’s lowest threshold:

| Account Type | Minimum Deposit (NGN) | Leverage | Spreads From | Commission |

| Standard | ₦3,000 | Up to Unlimited | 0.3 pips | None |

| Standard Cent | ₦10,000 | Up to Unlimited | 0.3 pips | None |

| Raw Spread | ₦200,000 | Up to Unlimited | 0.0 pips | Yes |

| Zero | ₦200,000 | Up to Unlimited | 0.0 pips | Yes |

| Pro | ₦200,000 | Up to Unlimited | 0.1 pips | None |

Exness does not enforce fixed minimums; these amounts reflect technical limits on deposit methods in Nigeria.

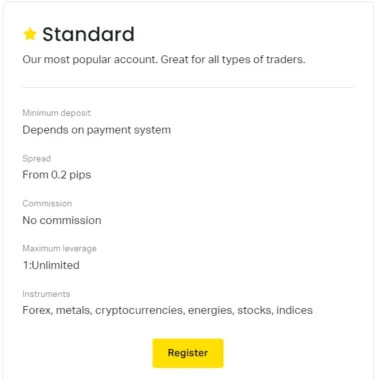

Standard Account: ₦3,000

The Standard Account is the most accessible option, designed for general trading in forex, metals, indices, and more, with no commission on trades. The low minimum deposit of approximately ₦3,000 (around $5 USD) makes it ideal for beginners.

Key points:

- Execution: Market execution.

- Hedged margin: 0%.

- Margin call: 60%.

- Stop out: 0%.

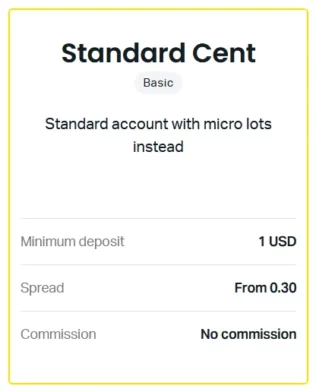

Standard Cent: ₦10,000

The Standard Cent Account is perfect for testing strategies with smaller real-money trades. The minimum deposit is around ₦10,000, and trades are placed in cent lots, reducing risk exposure in real market conditions.

Features include:

- Volume per position: From 0.01 cent lot.

- Max open orders: 1,000.

- Pending orders: 50.

- Account limit: 10 cent accounts per Personal Area.

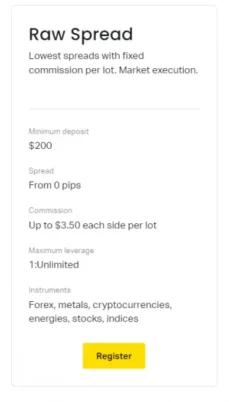

Raw Spread: ₦200,000

The Raw Spread Account is designed for experienced traders needing ultra-low spreads starting from 0.0 pips. The minimum deposit of ₦200,000 suits scalping and high-frequency trading.

Included:

- Commission-based trading model.

- Ultra-tight spreads.

- Access to over 200 CFD instruments.

- Available on MetaTrader 4 and MetaTrader 5.

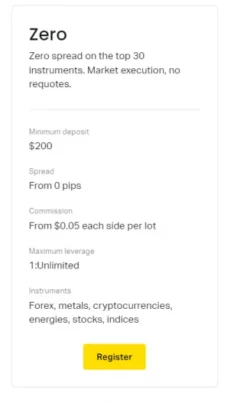

Zero Account: ₦200,000

This account mirrors the Raw Spread in deposit requirements but offers zero spreads on 30+ instruments for most of the trading day. It’s ideal for high-precision execution with fixed commissions.

Highlights:

- Ideal for algorithmic trading.

- Suitable for EA-based systems.

- Trade execution without slippage under stable conditions.

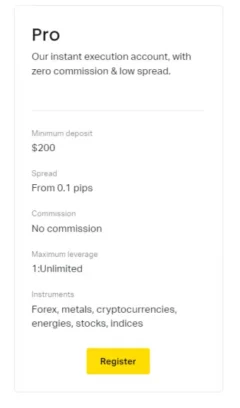

Pro Account: ₦200,000

Built for institutional-style traders, the Pro Account offers instant execution, narrow spreads, and no trading commission. It’s attractive for high-capital traders in Nigeria seeking consistent price performance.

Characteristics:

- Priority trade execution.

- Swap-free options.

- Variable spreads starting from 0.1 pips.

Exness Deposit Methods for Nigerians

Exness supports multiple deposit methods for Nigerian traders, with varying minimum requirements, processing times, and currency handling. Most methods enable instant deposits for immediate trading. The payment method may affect the minimum deposit due to technical limits.

Bank Transfer and Domiciliary Accounts

Bank transfers and domiciliary accounts (USD-based accounts offered by banks like Access Bank, GTBank, First Bank, Zenith Bank, and UBA) are popular for Nigerian traders, especially for larger deposits:

- Minimum deposit: ₦10,000.

- Maximum per transaction: Varies by bank, often ₦5,000,000+.

- Processing time: Within 1–3 hours.

- Currency supported: NGN or USD (domiciliary accounts).

- Fees: None charged by Exness.

Some banks may apply internal charges or currency conversion fees for non-NGN accounts. All deposits must come from personal accounts to comply with CBN’s anti-money laundering (AML) policies and Nigerian foreign exchange regulations.

E-wallet Options

Exness supports e-wallets like Neteller, Skrill, and WebMoney, which are popular among Nigerian traders for their flexibility and speed.

Skrill and Neteller:

- Minimum deposit: ₦10,000 (approx. $10 USD).

- Processing: Instant.

- Transfer currency: USD.

- Fees: Handled by Exness (0%).

WebMoney:

- Minimum deposit: $1 USD.

- Processing: Instant.

- Supported currency: USD.

- Exchange rate margin: May apply.

E-wallets are ideal for traders managing funds across multiple platforms or reacting quickly to market changes without banking delays.

Exness Currency Conversion

As most Exness trading accounts are denominated in USD, NGN deposits are automatically converted to USD at the time of credit. This process is transparent within your Personal Area.

USD to NGN Rates

Exness applies real-time market-based exchange rates for NGN-to-USD conversion, adjusted with internal buffers for risk management.

Example:

- NGN deposit: ₦10,000.

- Exchange rate applied: 1 USD = ₦1,600.

- Credited amount: Approx. $6.25.

Exchange rates may vary slightly depending on the payment method, especially for e-wallets involving third-party processors.

Conversion Fees

Exness does not charge separate currency conversion fees. However, payment systems or banks may apply exchange rate margins, slightly affecting the final USD credited:

| Fee Type | Exness |

| Currency conversion | 0% |

| Deposit handling fee | 0% |

| Bank or wallet markup | May apply |

To minimize costsintre cost:

- Use NGN-supported methods like bank transfers or domiciliary accounts.

- Avoid international credit cards with high foreign exchange markups.

Exness First Deposit Process

Making your first deposit on Exness is straightforward and takes under 10 minutes, tailored to Nigeria’s payment methods with automatic currency conversion:

- Log in to your Exness Personal Area (PA).

- Go to “Deposit” and select your preferred method (e.g., Bank Transfer, Domiciliary Account, Skrill).

- Enter the deposit amount in NGN or USD (for domiciliary accounts).

- Confirm the transaction via the provider interface.

- Funds are credited instantly or within 3 hours for bank transfers.

Your trading account will reflect the USD equivalent based on Exness’s internal exchange rate. For example, a ₦10,000 deposit at 1 USD = ₦1,600 yields approximately $6.25. Check system messages or margin requirements, especially for Pro or Zero accounts requiring larger capital.

Small Capital Trading

Exness supports traders starting with small deposits, particularly via Standard and Standard Cent accounts, optimized for low-capital exposure and real-market learning:

| Feature | Standard | Standard Cent |

| Minimum volume | 0.01 lot | 0.01 cent lot (1K cents) |

| Stop out level | 0% | 0% |

| Margin call | 60% | 60% |

| Maximum leverage | Up to Unlimited | Up to Unlimited |

With as little as ₦5,000, traders can engage with major forex pairs like EURUSD or USDJPY, ideal for testing strategies or monitoring price movements with minimal risk.

Example trading scenarios:

- Deposit: ₦10,000 → $6.25.

- Open position in EURUSD: 0.01 lot.

- Pip value: ~$0.10.

- 20-pip target: Estimated gain of $2 (~₦3,200).

This setup supports learning with tools like trailing stops, indicators, and micro-lot testing on MetaTrader 4.

Frequently Asked Questions

Can I start trading with ₦3,000 on Exness?

Yes, with bank transfers or e-wallets, you can begin with ₦3,000 on a Standard Account. Other account types require higher minimums.