- Registration Requirements

- Exness Account Registration Process

- Exness KYC Verification for Nigerians

- Address Proof Options

- Account Type Selection

- Real Account Options

- Demo Account Benefits

- Exness Registration Troubleshooting

- Post-Registration Steps

- Password Recovery Process

- Frequently Asked Questions

Registration Requirements

To trade with Exness in Nigeria, understanding the registration requirements is key to setting up your account smoothly and complying with Know Your Customer (KYC), Anti-Money Laundering (AML), and Nigerian foreign exchange regulations overseen by the Central Bank of Nigeria (CBN). Document verification typically takes 3 to 30 minutes if submitted correctly.

Eligibility Criteria

Traders must be at least 18 years old, verified by proof of identity. Exness supports Nigerian clients but excludes jurisdictions like the United States. A valid email and phone number are required for account creation and two-factor authentication (2FA). Users must confirm they are not from restricted regions during registration.

Required Documents

Exness requires documents for identity and residence verification to ensure security and compliance with CBN and SEC Nigeria (Securities and Exchange Commission) regulations. Nigerian traders need:

- Proof of Identity (POI): A valid passport, National Identification Number (NIN), or Bank Verification Number (BVN) showing full name, date of birth (confirming age 18+), and a clear photo. Black-and-white or expired documents are not accepted.

- Proof of Residence (POR): A utility bill, bank statement, or rental agreement (no older than 3 months) showing the trader’s name and address, matching registration details.

- Additional Requirements: In 10% of cases, Exness may request proof of income (e.g., salary slip) to comply with Nigerian foreign exchange regulations.

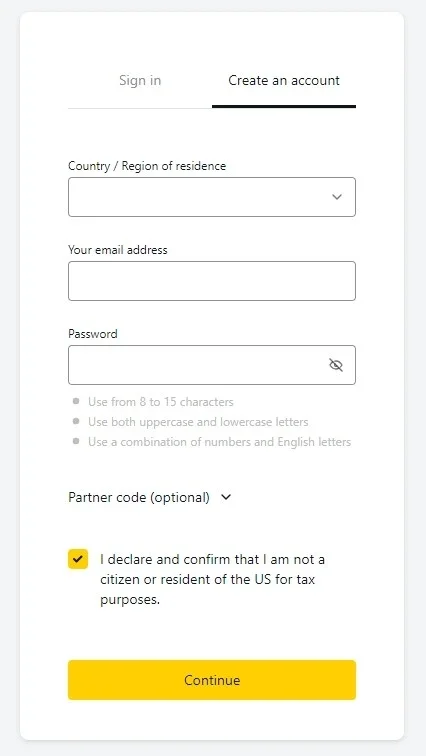

Exness Account Registration Process

Registering with Exness takes 2 to 5 minutes via the website (www.exness.com) or the Exness Trade app. Follow these steps to set up a Personal Area (PA):

- Visit the official website or app: Go to www.exness.com or open the Exness Trade app. Verify authenticity with the padlock icon.

- Click “Sign Up”: Locate the yellow “Sign Up” button on the homepage.

- Enter details: Select Nigeria as your country, provide a valid email address and phone number, and create a password (minimum 8 characters, including upper and lower case letters).

- Confirm not in restricted regions: Check the box to confirm you’re not in restricted areas like the United States.

- Verify email and phone: Click the email verification link and enter the 6-digit OTP sent via SMS.

- Access your Personal Area: Manage accounts and trades after verification.

About 95% of users complete this process smoothly, but 5% encounter issues, such as using a registered email. Use “Forgot Password” or contact support via live chat (available in English, Hausa, Yoruba, and Igbo) for assistance.

Exness KYC Verification for Nigerians

KYC verification is essential for Nigerian traders to fully access their accounts, which includes higher deposit limits. Exness adheres to the guidelines set by the CBN, SEC Nigeria, and Nigerian foreign exchange regulations. Once the documents meet the requirements, 90% of verifications are completed in less than ten minutes.

NIN/BVN Upload

The National Identification Number (NIN) or Bank Verification Number (BVN) is widely accepted for identity verification. Requirements include:

- Clarity: Submit a high-quality, color scan/photo showing the full NIN/BVN, name, and photo. Blurry images cause 60% of rejections.

- Mask Sensitive Details: Mask the first 8 digits of the NIN for security.

- Match Details: Ensure name and date of birth match registration details to avoid 30% of delays.

- File Format: Use JPG, PNG, or PDF (max 50 MB).

Passport Requirements

A passport can also be used for identity verification. Key points:

- Validity: Must be active; 5% of rejections are due to expired documents.

- Clarity: Ensure name, date of birth, and passport number are clear. 25% of rejections are due to poor quality.

- Consistency: Name must match registration details; 20% of delays are due to discrepancies.

- Color Image: Black-and-white copies are not accepted (10% of rejections).

Address Proof Options

Proof of residence must be no older than 3 months and match the registered address. Options include:

- Utility Bills: Electricity, water, or gas bills (50% of verifications).

- Bank Statements: From recognized banks like Access Bank, GTBank, First Bank, Zenith Bank, or UBA (30% of cases).

- Rental Agreements: Signed leases (15% of submissions).

- Tax Documents: Recent tax returns (5% of cases).

Documents must be in color with all corners visible. Utility bills are used by 70% of Nigerian traders due to availability:

| Document Type | Accepted Examples | Key Requirements | Common Rejection Reasons |

| Proof of Identity | NIN, BVN, Passport | Color, valid, full name, photo | Blurry images, expired documents |

| Proof of Residence | Utility bill, Bank statement | No older than 3 months, matching address | Outdated documents, mismatched address |

Account Type Selection

Choosing an account type is crucial post-registration and verification. Exness offers real and demo accounts tailored to various trading styles, with over 2 million accounts opened globally.

Real Account Options

Exness provides real account types for diverse strategies, with 80% of Nigerian traders selecting these post-verification:

- Standard Account: Ideal for beginners, with a ₦3,000 minimum deposit (approx. $5 USD), spreads from 0.3 pips, and leverage up to 1:2000. Supports 36 forex pairs, 10 cryptocurrencies, and 20 commodities. Chosen by 60% of new Nigerian traders.

- Standard Cent Account: For micro-trading, with a ₦3,000 minimum deposit, spreads from 0.3 pips, and leverage up to 1:2000. Popular among 15% of Nigerian traders.

- Pro Account: For experienced traders, with a ₦5,000 minimum deposit (approx. $10 USD), spreads from 0.1 pips, no commission, and leverage up to 1:2000. Preferred by 20% of professionals.

Demo Account Benefits

Demo accounts, used by 50% of Nigerian traders, offer ₦5,000,000 in virtual funds to practice trading:

- Practice Trading: Test strategies on 120+ instruments with real-time data, boosting confidence for 70% of users.

- Platform Familiarity: Learn MetaTrader 4, MetaTrader 5, or Exness Terminal, used by 90% of traders globally.

- Strategy Testing: Experiment with leverage and order types risk-free, with 30% of users developing automated systems.

Exness Registration Troubleshooting

About 5% of users face registration or verification issues. Exness offers 24/7 live chat in English, Hausa, Yoruba, and Igbo, plus a Help Center with 500+ articles. Common issues:

- Email Verification Failure: Check spam/junk folders or resend the email link (60% of cases).

- Document Rejection: Blurry photos cause 70% of rejections. Re-upload clear, color scans in JPG or PNG.

- Phone Number Issues: Verify the country code (+234) or retry after 5 minutes (80% of cases).

Post-Registration Steps

Post-registration steps take 5-15 minutes to start trading:

- Fund Your Account: Deposit via bank transfer, domiciliary accounts, or NGN deposits (₦3,000 minimum). Bank transfers via Access Bank, GTBank, First Bank, Zenith Bank, or UBA are used by 70% of Nigerian traders for instant deposits.

- Download Trading Platform: Install MetaTrader 4, MetaTrader 5, or Exness Trade app. MT5 is preferred by 80% for advanced tools.

- Set Up Security: Enable 2FA via SMS or Google Authenticator (90% adoption).

Password Recovery Process

About 10% of traders face login issues due to forgotten passwords, with 95% resolved in 5 minutes:

- Access Recovery Page: Click “Forgot Password” on www.exness.com or the app.

- Enter Registered Email: Use the email linked to your account.

- Receive Reset Link: Check inbox or spam for the link within 1-2 minutes.

- Create New Password: Use at least 8 characters, including letters, numbers, and special characters.

- Log In Again: Access your Personal Area and enable 2FA (85% of cases post-recovery).

Frequently Asked Questions

How old do you have to be to sign up with Exness?

Traders must be 18 years old, verified by NIN, BVN, or passport. About 5% of rejections are due to age discrepancies.