What Is a Spread in Exness?

In forex and CFD trading, a spread refers to the difference between the bid price (the price a trader can sell at) and the ask price (the price a trader can buy at). This gap is measured in pips and essentially represents the cost of opening a position. At Exness, spreads are a core component of pricing and can vary depending on the account type, instrument, and market conditions.

Unlike fees or commissions that are clearly listed, the spread is often an invisible cost that affects the net outcome of every trade. A tighter spread means lower trading costs, especially important for short-term strategies such as scalping or high-frequency trading.

Exness offers a range of accounts with different spread structures to suit various trading styles, from beginners looking for simplicity to advanced traders focusing on execution and raw pricing.

How Exness Calculates Its Spreads

Exness operates as a market maker and a bridge to liquidity providers. It aggregates price feeds from top-tier liquidity sources and displays the most competitive bid/ask pairs to traders. The spread is dynamically calculated based on real-time market depth and volatility.

For most accounts, the spread is variable. This means it can widen during periods of low liquidity (such as during major news events or after market hours) and narrow when the market is highly liquid. Exness does not interfere with or manipulate spreads; instead, they reflect real market conditions and execution quality.

Spreads are displayed transparently in the Market Watch section of MetaTrader 4 or MetaTrader 5, and traders can monitor spread movements by enabling the spread column.

Fixed vs Variable Spreads at Exness

Exness primarily offers variable spreads across all its live account types. This model allows for tighter pricing, especially during peak market hours. However, it’s important to understand the distinction between fixed and variable spreads when selecting an account:

| Feature | Fixed Spreads | Variable Spreads |

| Spread Stability | Constant | Changes based on market flow |

| Typical Cost Range | Usually higher | Can be very low |

| Slippage Potential | Low | Can occur during volatility |

| Market Conditions Needed | Stable markets | Dynamic, adapts to liquidity |

| Availability at Exness | Not offered | Available on all account types |

Traders who rely on precision and flexibility generally prefer variable spreads, especially when backed by fast execution systems. This is one of the reasons Exness focuses exclusively on variable spread models across its accounts.

Exness Account Types and Their Spreads

Exness offers multiple account types, each tailored to a specific trading approach. These include Standard, Pro, Raw Spread, and Zero accounts. Each one has distinct spread characteristics, ranging from beginner-friendly options to ultra-tight conditions suited for professional strategies.

Standard Account (From 0.3 pips)

The Standard account is ideal for beginners and casual traders. It combines simplicity with low entry requirements — there’s no minimum deposit and spreads start from 0.3 pips. No commission is charged, and all trading costs are embedded in the spread.

This account supports all major instruments: forex pairs, metals, indices, energies, stocks, and cryptocurrencies. It also offers unlimited leverage depending on region and regulatory conditions.

Key features:

- Market execution.

- Floating spreads starting at 0.3 pips.

- No commission.

- Ideal for those learning how to trade or testing manual strategies.

Pro Account (From 0.1 pips)

The Pro account is a step up in terms of execution and pricing. It’s designed for experienced traders who require lower trading costs and faster execution. Spreads start from 0.1 pips, and like the Standard account, there are no commissions.

Due to its pricing and execution speed, this account suits scalpers, intraday traders, and algorithmic systems. It is only available with market execution and offers access to the full range of tradable assets.

Key features:

- Tight floating spreads from 0.1 pips.

- No commission.

- Market execution only.

- Prioritized execution speeds.

Raw Spread Account (From 0.0 pips + commission)

The Raw Spread account offers direct-market pricing with spreads from 0.0 pips. However, it introduces a commission model — traders pay a fixed fee per traded volume, typically $3.50 per side per lot, though this varies depending on the instrument.

This account is well-suited for algorithmic traders and high-frequency strategies where spread sensitivity matters more than total cost structure. Execution is also market-based, ensuring fast order processing.

Key features:

- Institutional-grade pricing.

- Spread from 0.0 pips.

- Commission charged per trade.

- Transparent cost structure.

Zero Account (0 pips on 30+ instruments)

As the name suggests, the Zero account provides zero spread on over 30 trading instruments, including top forex pairs. This zero spread is available for up to 95% of the trading day depending on market conditions.

Instead of charging through the spread, Exness applies a commission that varies depending on the instrument. For traders who prioritize price precision and are working with tight SL/TP levels, the Zero account provides cost predictability and optimal pricing.

Key features:

- 0 pip spreads on key instruments.

- Commission charged per transaction.

- Ideal for traders using EAs or scalping methods.

- Execution optimized for speed and reliability.

Spread Comparison by Instrument

Exness offers a broad range of trading instruments, each with its own typical spread behavior. The actual spread on any position depends on market volatility, trading hours, and the account type. Below is a breakdown of how spreads behave across the most traded asset categories on the platform.

EURUSD and Major Pairs

EURUSD is one of the most traded currency pairs globally and typically comes with the tightest spreads on all Exness accounts. On the Zero and Raw Spread accounts, spreads can be as low as 0.0 pips during peak market hours. On Standard and Pro, the average spread ranges from 0.3 to 1.0 pips, depending on liquidity:

| Account Type | Typical EURUSD Spread | Commission |

| Standard | 0.3 – 1.0 pips | None |

| Pro | 0.1 – 0.6 pips | None |

| Raw Spread | 0.0 – 0.3 pips | Yes |

| Zero | 0.0 pips | Yes |

Other major pairs such as GBPUSD, USDJPY, and AUDUSD follow similar patterns but may show slightly wider spreads during off-peak times.

Gold (XAUUSD) Trading Costs

Gold (XAUUSD) is popular for its volatility and high intraday range. At Exness, spreads on gold vary significantly depending on the account type and market session:

- On the Zero account, spreads can remain at 0.0 pips for most of the day.

- Raw Spread offers highly competitive pricing, starting from around 0.1 pips.

- Pro account users typically see spreads between 0.3 and 0.6 pips.

- Standard account holders may experience spreads between 0.5 and 1.2 pips.

Gold spreads tend to widen during rollover periods or when major macroeconomic news is released. Traders who focus on metals should keep an eye on volatility patterns throughout the day.

Oil and Commodities

Oil instruments such as USOIL (WTI) and UKOIL (Brent) come with floating spreads that reflect global energy market conditions. Spreads on oil CFDs can be wider than those on forex pairs, especially during high-impact news events or when liquidity is low:

| Instrument | Typical Spread Range | Account Suitability |

| USOIL | 0.5 – 2.5 pips | Zero, Raw, Pro |

| UKOIL | 0.7 – 2.8 pips | Zero, Raw, Pro |

| XNGUSD | 1.5 – 4.0 pips | Pro, Raw Spread |

While spreads are higher for commodities than for major forex pairs, they remain competitive compared to the broader industry, particularly on Raw Spread and Zero accounts where execution quality helps balance total cost.

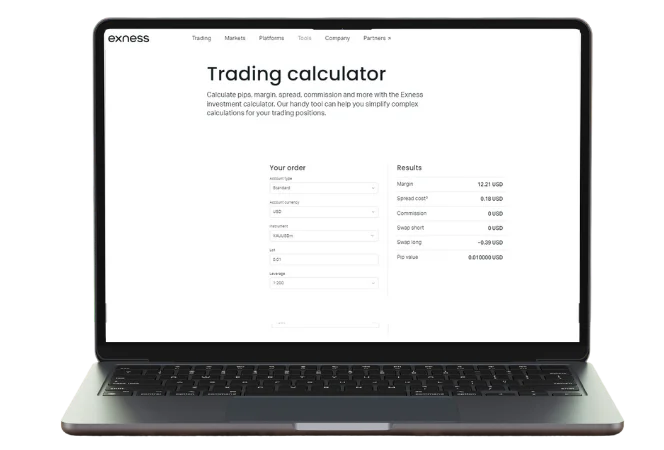

Understanding the Exness Spread Table

Exness provides a real-time spread table in the trading platform or Personal Area. This table outlines average and minimum spreads across all instruments. Interpreting it correctly can help traders:

- Choose the most cost-effective time to trade specific assets

- Compare spreads across account types

- Identify high-volatility instruments with wider spreads

- Monitor instruments where spreads stay consistently low (e.g. EURUSD, USDJPY)

How Exness Spreads Compare to Other Brokers

When evaluating a broker, one of the key metrics is trading cost — and spread is at the center of that. Exness consistently ranks among brokers offering some of the tightest spreads in the retail forex industry. Here’s how its spreads stack up:

| Broker | EURUSD (min spread) | Gold (XAUUSD) | Raw Spread Availability | Zero Spread Option |

| Exness | 0.0 pips | 0.0 pips | Yes | Yes |

| IC Markets | 0.1 pips | 0.2 pips | Yes | No |

| Pepperstone | 0.0 pips | 0.2 pips | Yes | Limited |

| XM | 0.6 pips | 0.5 pips | No | No |

| FXTM | 0.5 pips | 0.3 pips | Yes | No |

Exness stands out for offering:

- Zero pip spreads on major pairs and metals for large portions of the trading day.

- Consistently low spreads even on volatile instruments like gold and oil.

- Transparent spread tables across account types.

Additionally, its unique Stop Out Protection mechanism allows many traders to remain in trades longer without incurring higher spread-related risks during volatile periods.

Tips to Minimize Trading Costs with Exness Spreads

Spreads are an unavoidable trading cost, but they can be managed with planning and discipline. Here are practical ways to reduce the impact of spreads when trading on Exness:

- Use Low-Spread Accounts: Select accounts such as Raw Spread or Zero for lower per-trade costs. Though these charge commissions, the overall cost is often lower than trading on a wider-spread account.

- Trade During Peak Market Hours: Spreads are typically narrower when markets are active — such as during London and New York sessions. Avoid placing trades during weekends or rollovers unless necessary.

- Avoid Illiquid Instruments: Instruments with low trading volume tend to have wider spreads. Stick to major pairs or metals where spreads stay consistent and tight.

- Utilize the Spread Table: Before placing trades, consult the real-time spread data provided within MetaTrader. Monitoring this helps you avoid instruments that may be temporarily volatile.

- Monitor Market Events: High-impact news can cause spreads to widen suddenly. Either avoid trading during these times or reduce position size to limit exposure to spread fluctuations.

Frequently Asked Questions

Are Exness spreads fixed or variable?

All Exness accounts operate on variable spread models. This means spreads fluctuate based on real-time market liquidity and volatility.