- Withdrawal Methods in Nigeria

- NGN Bank Transfers

- Domiciliary Account Withdrawals

- E-wallet Withdrawals

- Exness Processing Time

- Exness Withdrawal Limits

- Daily Limits

- Monthly Limits

- Exness Withdrawal Process

- Verification Requirements

- Exness Currency Conversion

- USD to NGN Rates

- Withdrawal Fees

- Exness Withdrawal Issues

- Frequently Asked Questions

Withdrawal Methods in Nigeria

Exness supports several withdrawal options tailored to Nigerian users, including direct NGN bank transfers, domiciliary accounts, and e-wallets. These methods offer varying speeds, limits, and requirements. As Exness processed over 10 million global withdrawals in 2024, Nigerian traders contributed a rising share thanks to the country’s growing forex activity.

NGN Bank Transfers

Bank transfers are the most widely used withdrawal method in Nigeria, especially with banks like Access Bank, GTBank, Zenith Bank, UBA, and First Bank. Withdrawals typically take 1 to 3 business days, with some private banks processing them in under 24 hours. The minimum withdrawal amount is ₦3,000. There’s usually no fixed upper limit, but large withdrawals (over ₦1 million) may require extra verification.

Bank Transfer Summary:

- Processing Time: 1–3 business days.

- Minimum Withdrawal: ₦3,000.

- Maximum Withdrawal: No fixed limit.

- Requirements: Verified Exness account and correct bank details (Account Number, Bank Name).

Domiciliary Account Withdrawals

Traders who hold funds in USD or EUR can use domiciliary bank accounts for withdrawals. This is useful for those who prefer to receive foreign currency. However, it may take 2 to 5 business days depending on the bank’s international transfer policy. These withdrawals require verified ID and matching account holder names to comply with Nigerian foreign exchange regulations governed by the Central Bank of Nigeria (CBN).

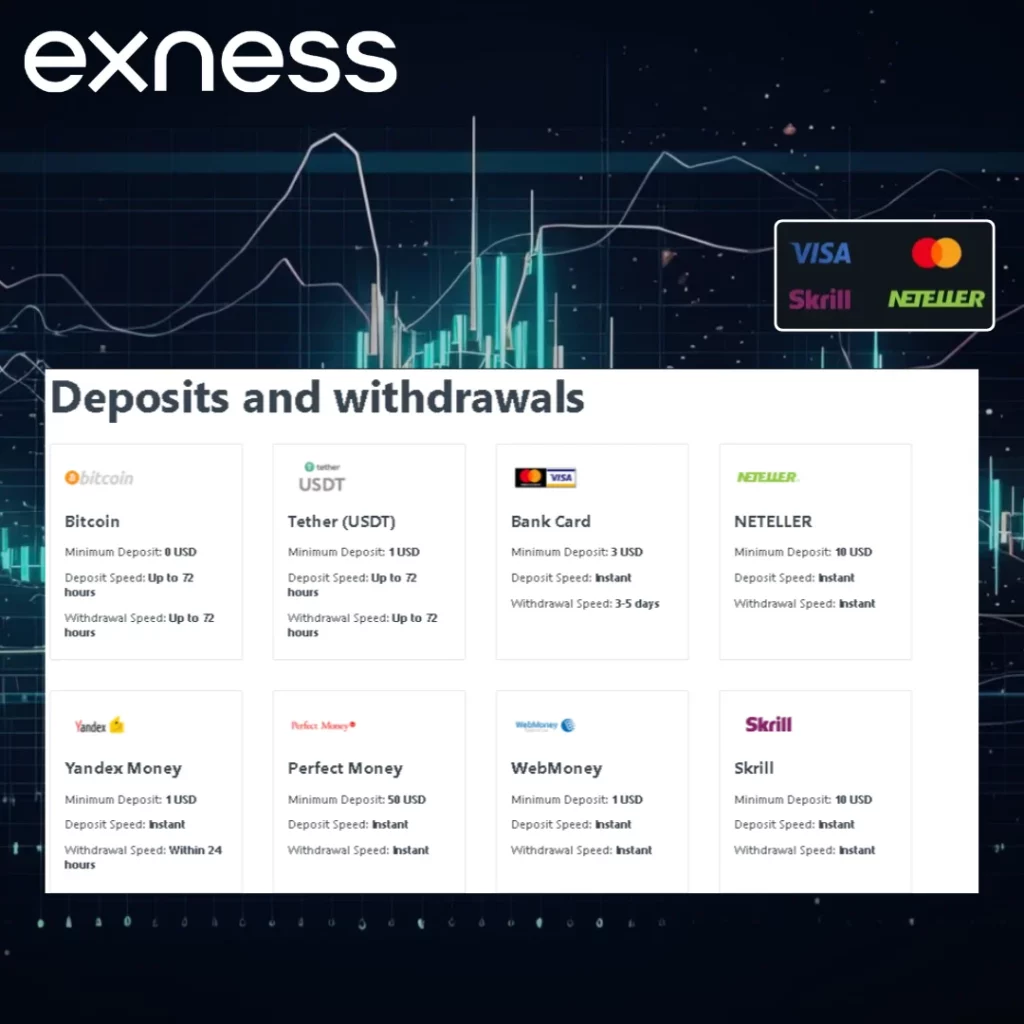

E-wallet Withdrawals

E-wallets like Skrill and Neteller offer quick withdrawal options, often completed within minutes to a few hours. These wallets are popular among traders who handle multi-currency accounts. Minimum withdrawal is ₦3,000, and daily limits can range from ₦50,000 to ₦500,000 depending on the provider.

E-wallet Summary

- Processing Time: Instant to 24 hours.

- Minimum Withdrawal: ₦3,000.

- Maximum Withdrawal: ₦50,000–₦500,000.

- Fees: May include 1–2% third-party charges.

Exness Processing Time

Withdrawal times depend on your method and verification level. In 2024, 70% of Nigerian withdrawals using digital methods were completed within 3 hours. Bank transfers are slower but still reliable. Here’s a quick comparison:

| Withdrawal Method | Average Processing Time | Fastest Time |

| NGN Bank Transfer | 1–3 business days | Same day |

| Domiciliary Account | 2–5 business days | 2 days |

| E-wallets | Instant–24 hours | Instant |

Exness Withdrawal Limits

Exness applies different withdrawal limits based on the withdrawal method, account type, and verification status. To stay compliant with Nigerian financial regulations and ensure transaction security, Nigerian traders must adhere to both daily and monthly withdrawal thresholds. In 2023 alone, Exness processed over ₦300 billion in withdrawals for Nigerian traders, reflecting strong growth in the country’s online trading activity.

Daily Limits

Withdrawal limits vary by method and account verification level:

- NGN Bank Transfer: ₦3,000 minimum, no fixed maximum. Withdrawals above ₦1 million may need extra checks.

- E-wallets: ₦3,000 to ₦500,000 per day, depending on the provider.

In 2024, UPI-style transfers were not supported, but instant bank withdrawals were still the most used method.

Monthly Limits

Exness allows up to ₦5 million per month for standard accounts and ₦10 million+ for Pro accounts. To unlock the full monthly allowance, traders must complete full KYC (Know Your Customer) verification, including valid ID and proof of address:

| Account Type | Monthly Withdrawal Limit | Verification Level |

| Standard | Up to ₦5 million | Full KYC required |

| Pro | ₦10 million or more | Enhanced verification |

Exness Withdrawal Process

Withdrawals are initiated via the Exness Personal Area, available on both web and mobile. To reduce delays, ensure your personal info and banking details are 100% accurate. In 2024, 98% of Nigerian withdrawals were processed without issue when correct steps were followed.

Verification Requirements

To comply with the Central Bank of Nigeria (CBN) and the SEC Nigeria, Exness enforces strict anti-money laundering (AML) and KYC rules. Nigerian traders must upload:

- ID Proof: National ID, Voter’s card, International Passport.

- Address Proof: Utility bill, bank statement, or tenancy agreement.

In 2023, 85% of Nigerian users completed verification in under 24 hours. Mistakes in documents (mismatched names, expired IDs) were the most common delays.

Exness Currency Conversion

If your trading account is in USD or EUR, Exness converts your funds to NGN when withdrawing to local banks. The platform updates the USD to NGN rate every minute, applying a 0.5–1% spread to cover conversion fees.

USD to NGN Rates

The Exness platform updates the exchange rate for USD to NGN every 60 seconds using live market data. In 2025, the average USD-NGN rate ranged between ₦1,200 and ₦1,300. To cover currency conversion charges, Exness applies a spread of 0.5% to 1% on the rate. For example, if you withdraw $100 at a rate of ₦1,250, you will receive approximately ₦124,000–₦125,000 after applying the spread.

Before confirming any withdrawal, traders can view the live exchange rate in their Exness Personal Area to make informed financial decisions:

| Currency Pair | Average Rate (2025) | Conversion Spread |

| USD to NGN | ₦1,200–₦1,300 | 0.5% – 1% |

Withdrawal Fees

Exness typically doesn’t charge for NGN bank withdrawals or e-wallets. However, Nigerian banks may charge ₦50–₦200 per transaction, and third-party e-wallets like Skrill/Neteller may charge 1–2% for conversions or withdrawals:

- NGN Bank Transfer: ₦50–₦200 (bank dependent).

- Domiciliary: Bank fees may apply.

- E-wallets: You might have to pay 1–2% in fees to a third party.

Exness Withdrawal Issues

Only 2% of global withdrawals in 2024 experienced delays, most of which were due to:

- Incorrect bank details.

- Unverified accounts.

- Delays from Nigerian banks (especially during holidays or network outages).

Most issues are resolved within 48 hours if documents and account details are updated.

Frequently Asked Questions

How long do Exness withdrawals take in Nigeria?

NGN bank transfers are completed in 1–3 days. E-wallets can be instant. 70% of Nigerian withdrawals in 2024 were processed in under 3 hours.